Here’s what you need to know about finance influencers

Equities, bonds, forex, commodities, real estate, derivatives - if any of these interest you, you’d probably be interested in knowing about finance influencers too. Influencer marketing sure has come a long way over the past 10-15 years. One of the exciting developments in this realm is the rise of profession-specific influencers.

Finance influencers have come to the spotlight only in recent years. Millennials are increasingly looking to take greater control of their personal finances, and are relying on online courses to educate themselves about the best ways to manage their money. This is partly why banks, financial services, and insurance (BFSI) companies are now looking to incorporate influencers in their marketing strategy.

A quick look at finance influencer marketing

Finance influencers take it upon themselves to educate their audiences about topics in finance. Some of them share tips on managing personal finances, some focus on investment strategies, while others post commentary on the economy and financial markets.

While being a relatively new niche in influencer marketing, finance influencers have quickly garnered popularity in a short span of time. According to a list of 100 top finance influencers by Refinitiv, between February and August 2020, the influencers had 7 million followers, 6 billion impressions, 1.6 million engagements, and 38,500 posts.

Investment is an important segment of finance that is quickly capturing the interest of millennials. The onset of the coronavirus pandemic has brought about a significant increase in younger people entering the stock market, facilitated by platforms such as Robinhood and eToro. This has opened up a new opportunity for investment firms, giving them a new market segment to target.

Where can finance influencers be found?

1. LinkedIn

LinkedIn is perhaps the most reliable and influential platform for finance influencers. Influencers like Mohamed El Erian, April Rudin, and Jim Bianco are influential sources of opinion on a wide range of finance topics, such as financial markets, wealth management, macroeconomics, fintech, ESG investing, and many more. Their content isn’t targeted specifically towards the younger segment and can be benefitted from by anyone who is interested in these topics.

2. Instagram

Instagram is also one of the top platforms for finance influencers, but these ones have a relatively different feel to them compared to those on LinkedIn. Since Instagram’s users lie mainly in the 18-34 age group, influencers on this platform focus their content more towards younger audiences. Instagram finance influencers, such as My Fab Finance, Mrs. Dow Jones, and Wise Woman Wallet use creative ways to educate their audiences about personal finance management.

3. TikTok

Another popular, yet unusual platform where finance influencers can be found is TikTok. With over 800 million active users, you would know TikTok better as a platform where young adults post videos of dances, impersonations, and lip-syncing songs. But more recently, it has become a platform for finance influencers to post short videos to promote literacy about personal finance and investing. Influencers like Carmen Perez and Dr. Brad Klontz have taken it upon themselves to bust myths and misinformation propagated by some TikTok users about finance. TikTok offers these influencers a space to not only post informative content but also make it more fun and creative.

How can businesses benefit from finance influencers?

The financial sector can benefit from finance influencers since they can help financial institutions target the right market. Financial products have always been promoted using traditional media channels and have targeted middle to older age audiences. By leveraging social media influencers, banks and non-bank financial institutions can reach out to a much larger, younger audience.

Finance influencer marketing will help make the dissemination of investing and financial management information much smoother and make it seem less intimidating and complex for the audience. It is hence, a good way for BFSI companies to make their products more accessible and to remove that invisible barrier between the sellers and the consumers.

Beware of scams!

One thing to be wary of is the recent rise in scams and fake personal finance influencers, fueled primarily by the lockdowns during the coronavirus pandemic. These accounts are mainly found on Instagram, and claim to have enormous amounts of wealth, posting photos in their (likely non-existent) mansions with private jets, luxury cars, yachts, and vacations.

One of their most common tactics is to attract millennials into paying for subscriptions for courses or workshops on how to get wealthy by trading in the market. Some of them also claim to have mastered the art of trading stocks and lure their followers into investing money with them through promises of multiplying their investment. Brands and consumers must watch out for these scams and stay far, far away from such misleading accounts. Learn more about influencer marketing fraud and how to guard against it here.

How can Influencer Hub help you?

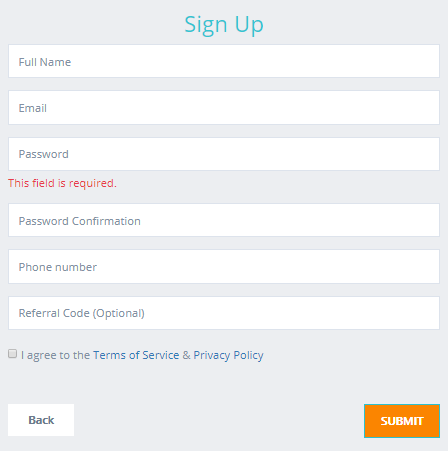

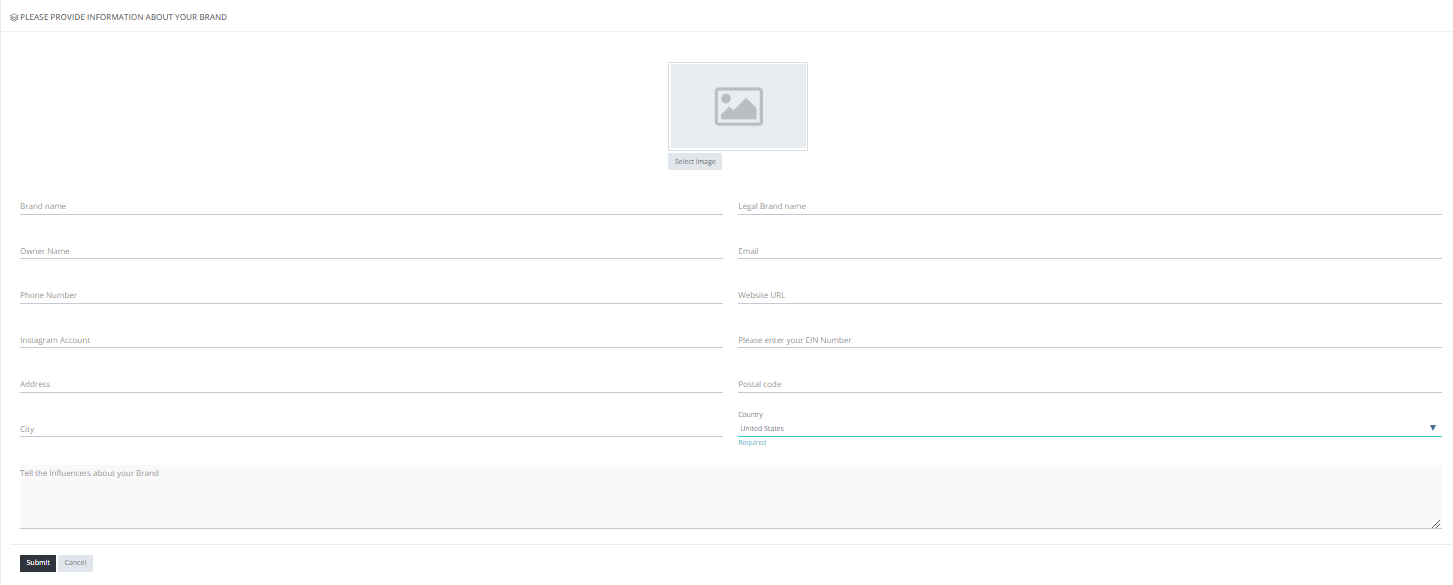

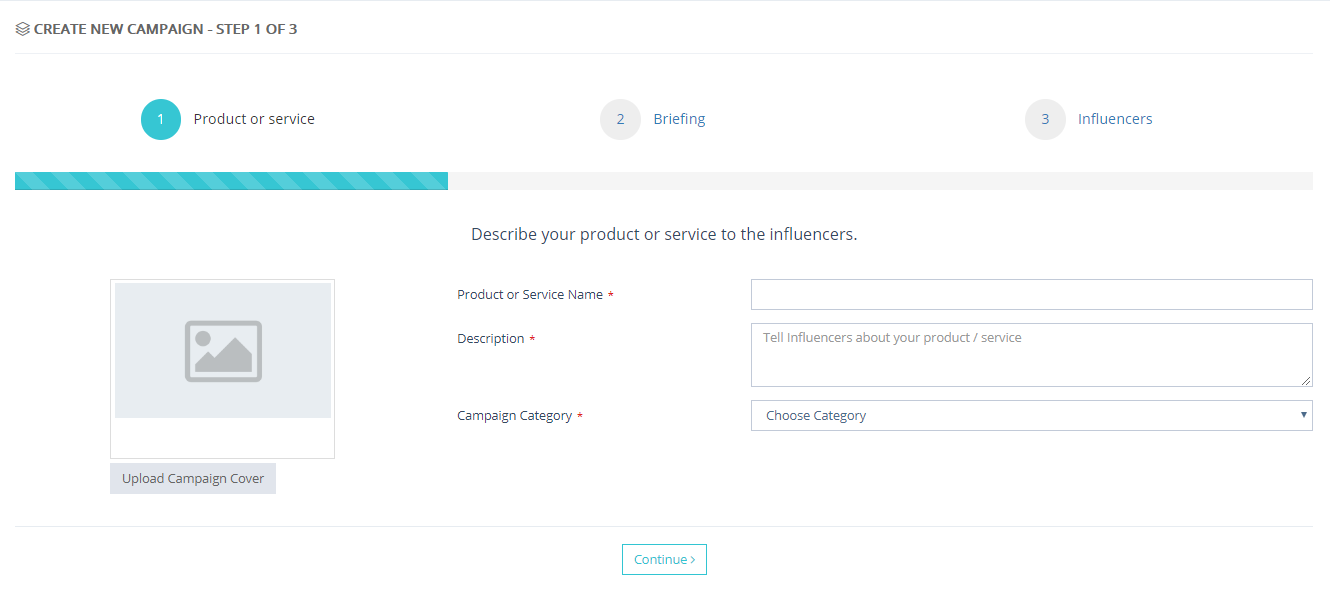

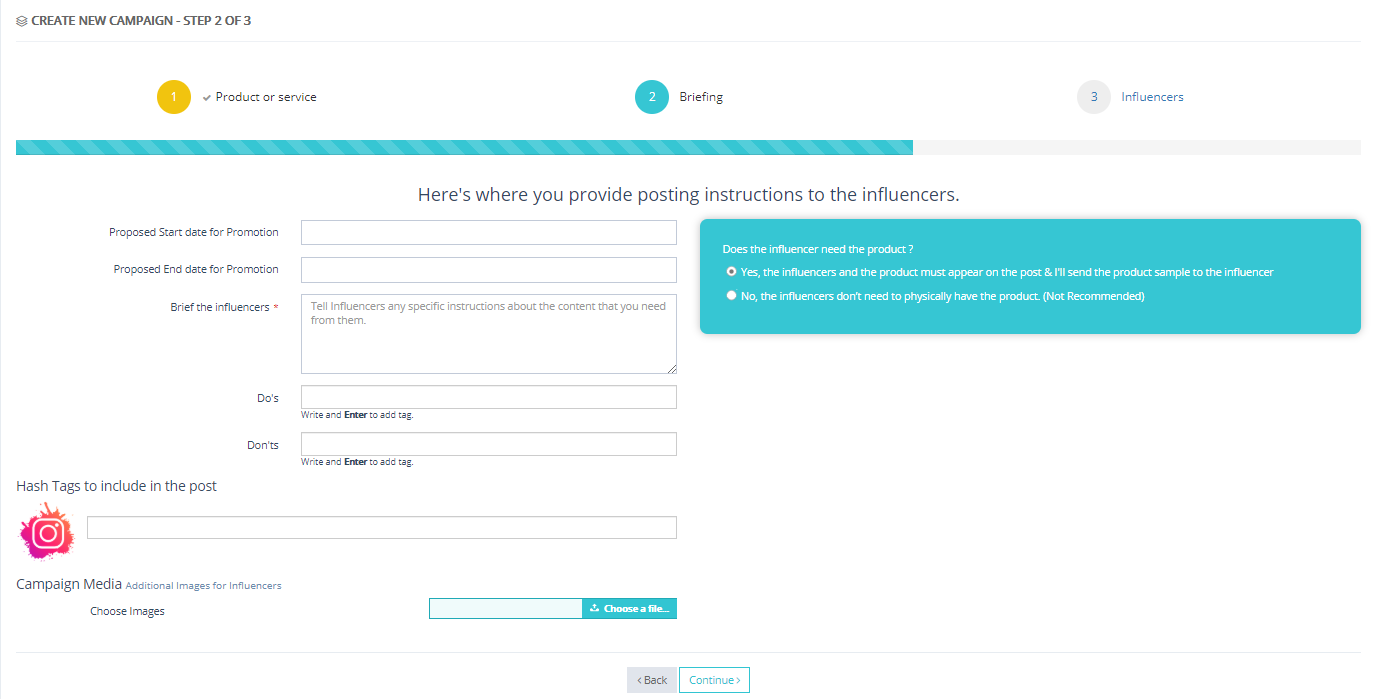

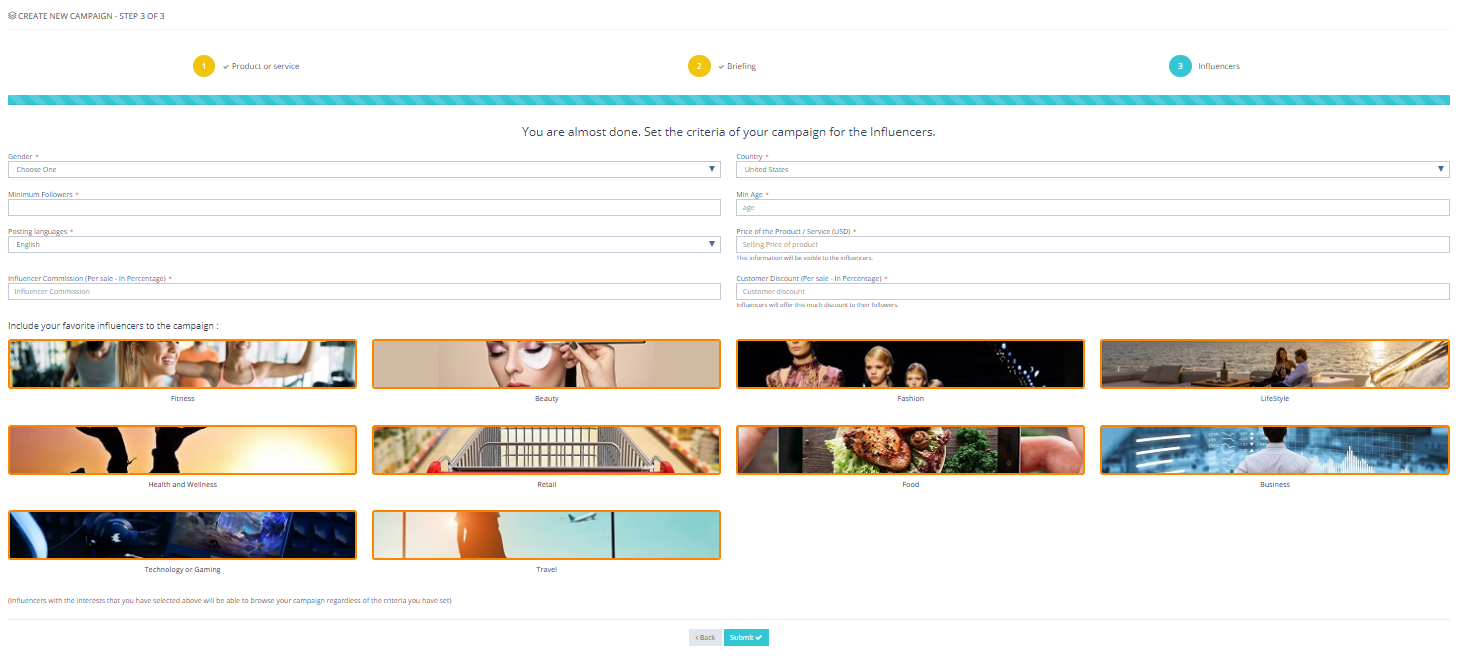

If you are a finance influencer and are looking to engage with brands for paid collaborations, Influencer Hub is that perfect platform for you. Similarly, if you are a BFSI business (or any other business for that matter!), you can sign up for free on Influencer Hub and collaborate with our registered influencers from a wide range of niches. Explore more about Influencer Hub here or sign up now as an influencer or brand to start your influencer marketing journey!